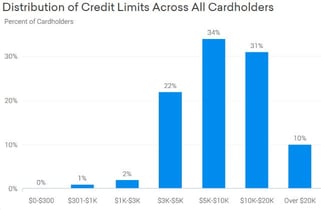

For the 6 of cardholders below 600 and perhaps even the 11 below 650 it s likely their scores took a hit sometime after having already been approved for the card.

Chase sapphire preferred credit score approval.

This is the biggest bonus for a personal chase credit card that earns chase ultimate rewards points so you ll want to do everything you can to ensure a successful.

The chase sapphire preferred is a great card and chase won t just approve anyone for it.

The chase sapphire preferred card is one of those cards affected by this rule.

However it s certainly possible to be approved for the chase sapphire preferred as a beginner.

Tips on how to get approved for the chase sapphire preferred.

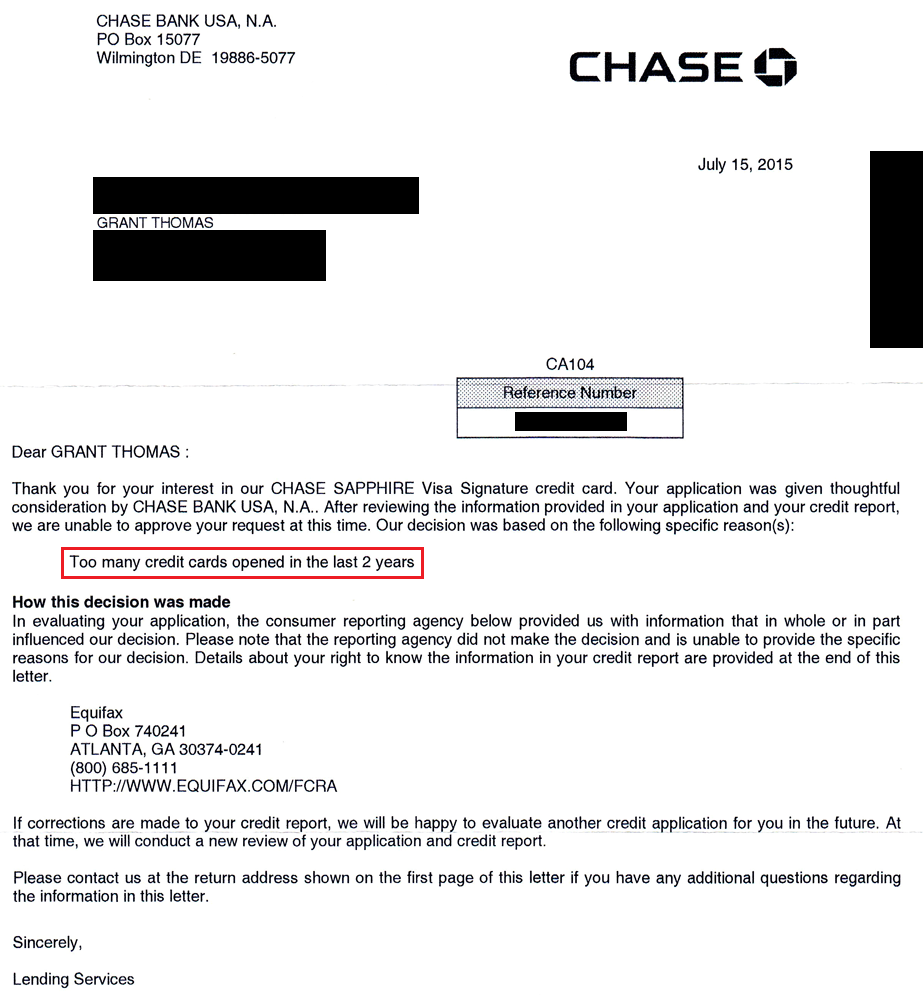

So if you ve opened at least 5 new credit card accounts in the last 24 months it is extremely unlikely you would be approved for the chase sapphire preferred card.

If you have a decent credit history a few accounts 3 to 5 years old or more a decent score somewhere close to 720 and an income of 50 000 you probably have some good odds of being approved.

This graph shows the credit scores of credit karma members who carry the chase sapphire preferred card.

After all tpg contributor ethan steinberg had no trouble getting approved for the chase sapphire preferred as his first card.

And the typical low score is 646.

Most cardholders have scores over 720 but there s no official score requirements to get the mid level credit card.

A credit score of at least 700 is usually required to be approved for the chase sapphire preferred card.

Final word on chase sapphire preferred approval odds.